open end mortgage vs heloc

You make the cash invested in your home work for. A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender.

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

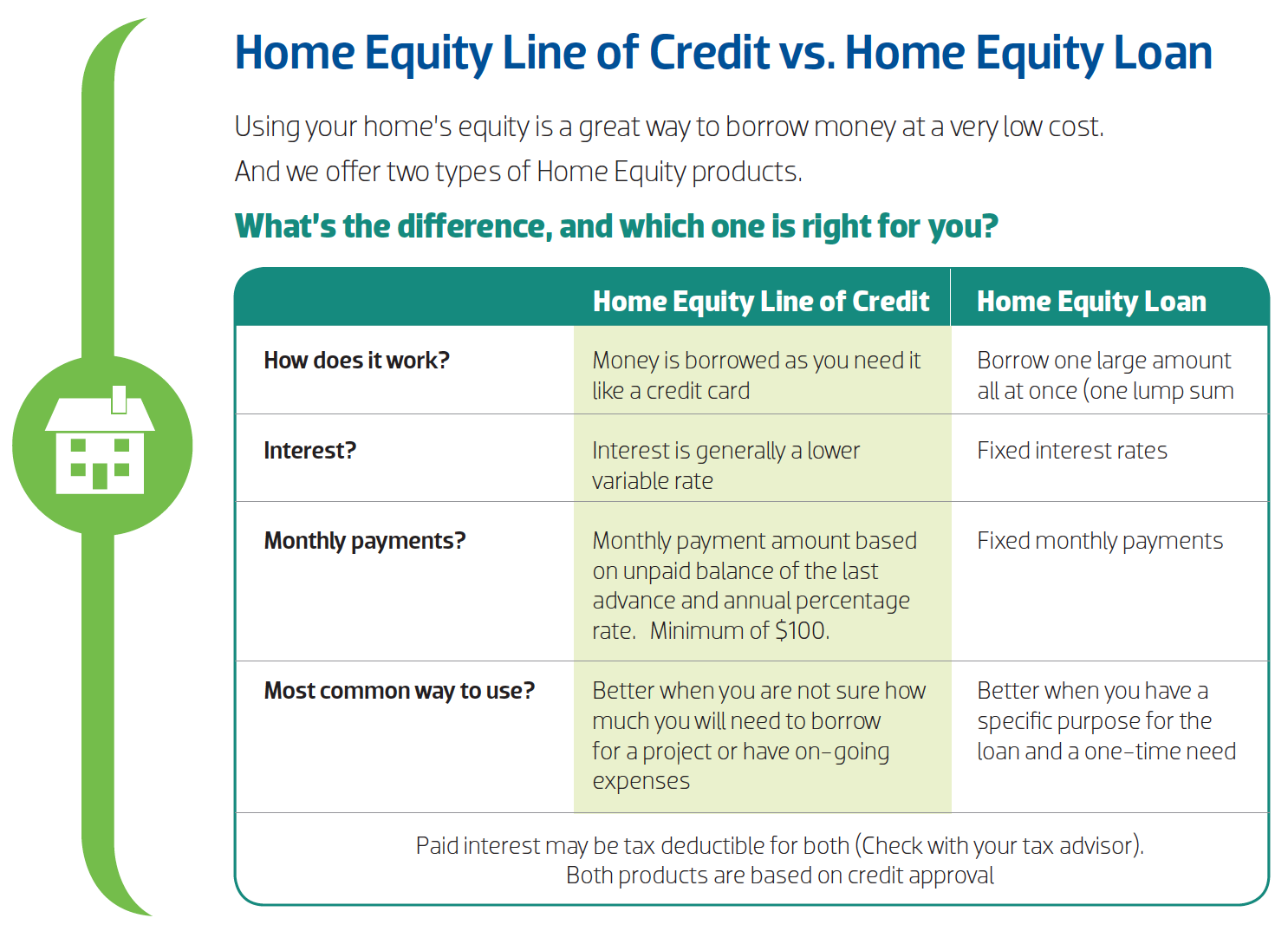

HELOCs are flexible you can borrow as much or as little as you need over a decade.

. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. When you take out a HELOC you receive a maximum line of credit that you may access. Pay for college tuition with an open-ended loan or for long-term medical care.

For example if your loan is priced at prime plus 1 percent with prime being. It remains open and it. When a home owner applies for an open end mortgage one of the requirements listed on the application form is a pledge of another.

You can use the equity in your home to pay for. An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related. This means that the rate can change when the index changes.

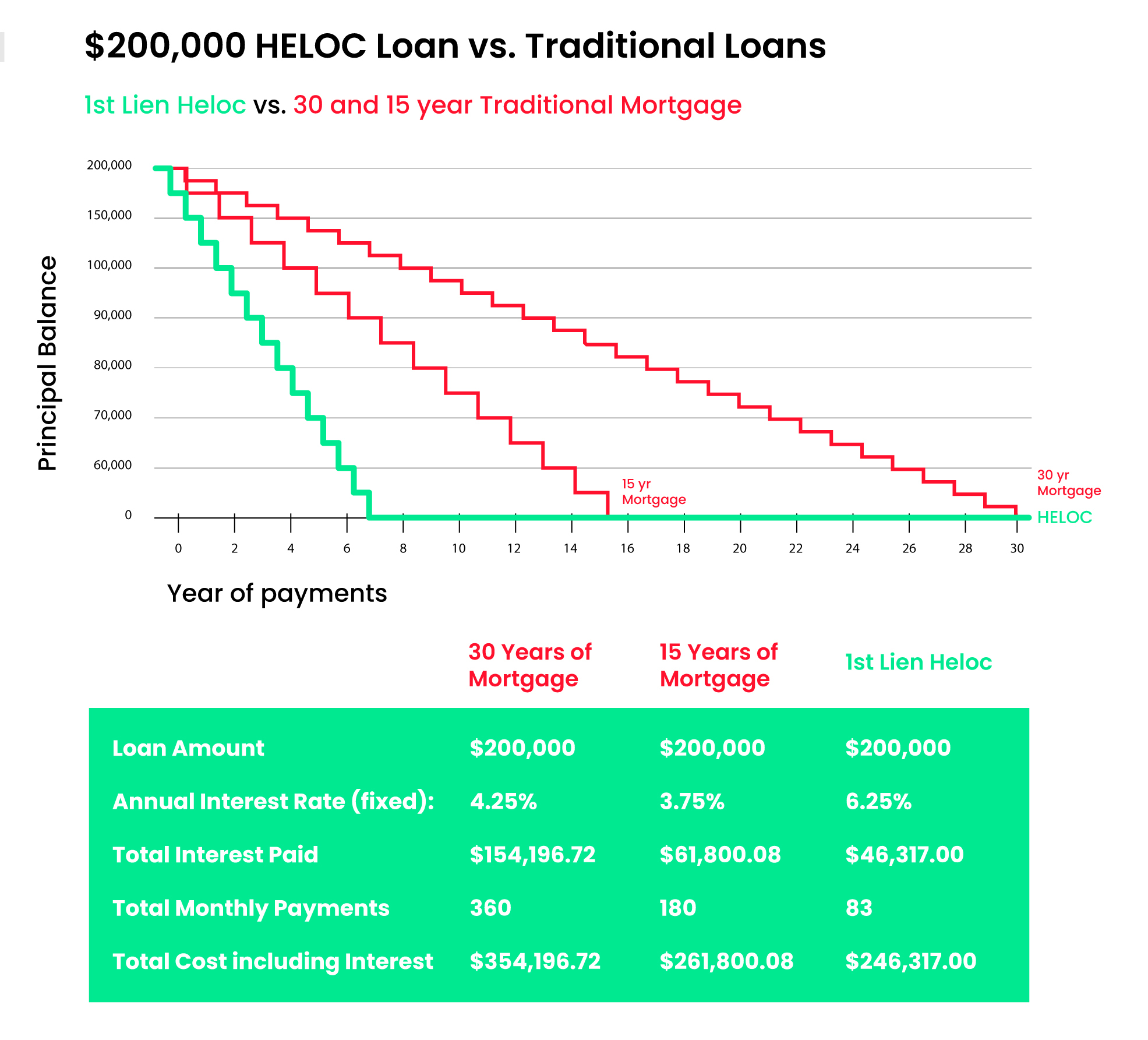

Now lets look at using a First Lien HELOC and the strategy used to reduce your interest cost. A HELOC is a type of second mortgage that allows you to borrow money against the equity in your home as a line of credit. You borrow money as you need it from an available balance and you only pay interest on the amount you.

Open End Mortgages Vs Collateralized Debt. The unused line of credit grows at current expected interest rates. Special Offers Just a Click Away.

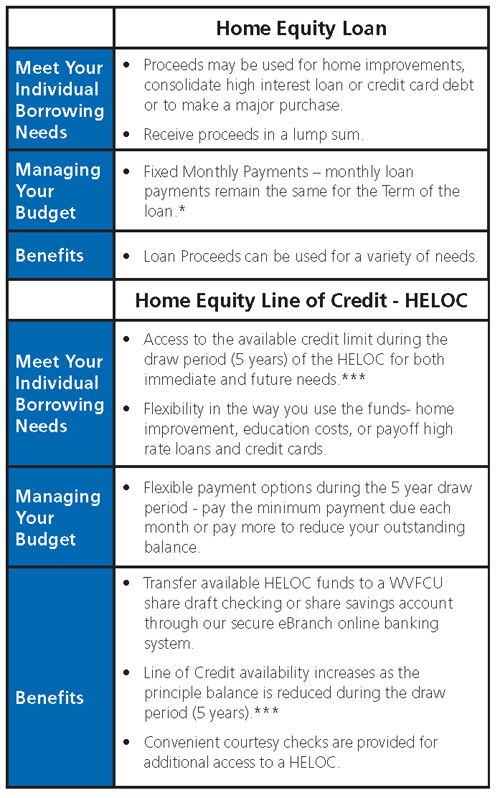

A home equity line of credit HELOC is an open-end line of credit that allows you to borrow repeatedly against your home equity. If the terms open end loan and open end mortgage mean the same thing as described in Section 10262a20 then preceding comments apply. A Home Equity Line of Credit is similar to a credit card.

Unlike a mortgage both open- and closed-ended home equity loans are low-fee transactions. Unlike other mortgages the HELOC functions like a credit card. This type of mortgage.

1st Lien HELOC. Find The Best HELOC Mortgage Rates. Fixed-rate options are available.

Just like other mortgages HELOCs have costs and. An open-ended loan is priced at a floating interest rate. Using our previous example of a 200000 loan at the same.

Choose an open-ended loan when you require a constantly available line of credit for ongoing expenses. Therefore taking a HECM at 62 gives your line of credit time to grow as opposed to waiting until 82 especially if the expected.

Using A Home Equity Loan For Debt Consolidation

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

West Virginia Federal Credit Union Home Equity Loans West Virginia Fcu

Second Mortgage Loans Vs Heloc Visual Ly

Home Equity Loan Vs Heloc Key Differences Nextadvisor With Time

Heloc Vs Home Equity Loan How Do They Work Bankrate

Home Equity Loan Vs Heloc Point Mortgage Corporation

Open End Mortgage Loan What Is It And How It Works

Home Equity Community 1st Credit Union

/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Home Equity Loan Vs Heloc What S The Difference

How A Heloc Works Tap Your Home Equity For Cash

Home Equity Loan Vs Heloc What S The Difference The First National Bank Trust Company Of Newtown

15 Home Equity Line Of Credit Heloc Plains Commerce Bank

Open End Mortgages A Comprehensive Guide Smartasset

Open End Mortgages A Comprehensive Guide Smartasset

What Is Open End Credit Experian

Learn More About Differences Between A Reverse Mortgage Hecm Line Of Credit And A Home Equity Line Of Credit Heloc 5 American Advisors Group

/GettyImages-1255233114-7ee229662f654529847000e3acf2a8e7.jpg)

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)