idaho education tax credit 2021

Grocery Credit - 100 per exemption An additional 20 may. Income that may be taxes by another state as well as Idaho is.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Income tax credit for charitable contributions Limitation.

. Idaho corporations may take up to 50 of a gift of 10000 a tax credit of 5000 These amounts reflect approximate rates for a joint return of 40000 taxable income and are based on the taxpayer who itemizes personal deductions. And we continue our focus on improving literacy for our youngest students and preparing older students for careers. January 19 2021 Agenda Minutes February 16 2021 Agenda Minutes March 16 2021 Agenda.

The Idaho State Board of Education makes policy for K-20 public education in Idaho to create opportunity for lifelong attainment of high-quality education research and innovation. Submit a Licensee Request for CE Credit form at least 60 days prior to your Idaho license renewal date. These back taxes forms can not longer be e-Filed.

Fuels Taxes and Fees. 160000 married filing jointly in one lump sum 3. Idaho Tax Credit 50 125 250 500 Total Savings for the Year 82 207 412 824 Your actual cost of the gift 18 43 88 176 Idaho Individuals may take up to 50 of a gift up to 1000 a tax credit of up to 500.

Continuing education units must be taken during the validity period of the certificate. 2021 Meeting Dates Agendas Minutes. Or take advantage of accelerated gifting to reduce your taxable income by contributing five years worth of gifts 80000 if single160000 if married filing jointly to an IDeal account in one year.

All Publications Search. Reduce your personal taxable estate by making five years worth of gifts up to 80000. Idahos Gender Gap in Go-On Rates.

Idaho doesnt conform to bonus depreciation for assets acquired after 2009. January 26 2022 By Cascade Library Staff. It doesnt have to cost a lot to make a big difference at Bishop Kelly.

Electricty Kilowatt Hour Tax. As I reported in an article earlier this year the 2021 Idaho Legislature passed a work-around for the 10000 federal limit on an individuals deduction of state and local taxes The new Idaho law effective January 1 2021 allows pass-through entities to elect to pay the Idaho income tax that otherwise would have been payable by the. E911 - Prepaid Wireless Fee.

As an Idaho tax payer your donations to the University of Idaho and the College of Engineering may be eligible for a 50 percent education tax credit which provides a reduction to the tax you owe or an increase in your refund. Products Pricing. IREC accepts many but not all courses taken in other jurisdictions and some courses offered for other professions.

HB 630 temporarily adds the Idaho Commission of. Current Book Review 2021 Archives. 2021 Readers Choice.

As an Idaho tax payer your donations to the University of Idaho and the College of Engineering may be eligible for a 50 percent education tax credit. Fifteen 15 contact hours are equivalent to one 1 semester credit hour. The property must have a useful life of three years or more and be property that youre allowed to depreciate or amortize.

Using non-Idaho CE for Idaho license renewal. North Star Charter School its Board and Administration do not provide any tax advice. EIN00046 11-15-2021 Page 2 of 64 General Information 2021 Whats New for 2021 Conformity to Internal Revenue Code IRC Idaho conforms to the IRC as of January 1 2021.

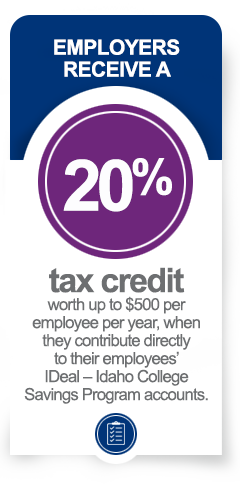

And libraries and museums qualify for the tax credit if they are located in Idaho. 20 tax credit for Idaho employers of up. A tax credit is a reduction to the actual tax you owe or an increase in your refund.

2021 Idaho State Board of Education. IT Help Desk. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

IDAHO EDUCATION TAX CREDIT. 50 of your Idaho tax 10 for Corporations 500 1000 if Married filing jointly 5000 for Corporations Your Idaho tax minus the amount of credit for income tax paid to other states. The continuing education units must be recognized by the appropriate Idaho state licensing board and can be used for the full six 6 semester credit renewal requirement.

Gift and estate tax benefits. A nonprofit corporation fund foundation research park trust or association organized and operated exclusively. Tax Credit is the smallest of.

Idaho STEM Foundation Tax Credit Information Author. The Idaho State Board of Education makes policy for K-20 public education in Idaho to create opportunity for lifelong attainment of high-quality education research and innovation. State income tax deduction for Idaho taxpayers of up to 6000 12000 married filing jointly per year from adjusted gross income 2.

Listed below are the credits that are available to you on your Idaho return. The two core priorities for Idaho throughout this school year are addressing the academic impact of lost instructional time and the challenges to student staff and community wellbeing created by COVID-19. One-half of the amount donated.

50 of your Idaho tax. Idaho State Income Tax Forms for Tax Year 2021 Jan. Idaho Education Tax Credit.

Tax Rate Reduction Effective January 1 2021 all tax rates have been decreased. Make a gift today and earn your Idaho Tax Credit this year while creating a significant impact at Bishop Kelly. Idaho STEM Action Center.

A qualified educational entity includes the following. Courses must fit within Rule 402 approved topics for CE and must relate to. BOARD RETREAT TO BE HELD THIS WEEK May 9 2022.

Even better you dont have to itemize your taxes to claim the tax credit. Idaho Education Tax Credit Home. Education Tax Credit Dec 29 2010.

At the election of the taxpayer there shall be allowed subject to the applicable limitations provided herein as a credit against the income tax imposed by chapter 30 title 63 Idaho Code an amount equal to fifty percent 50 of the aggregate amount of charitable contributions made by such taxpayer. Details on how to only prepare and print a Idaho 2021 Tax Return. For example if you give a 400 donation to Idaho Youth Ranch and your Idaho state tax bill is 1000 you could be.

Below are forms for prior Tax Years starting with 2020. In 2021 only deductions for cash contributions to public charities can now qualify for up to 100 of adjusted gross income previously limited to 60. 500 1000 if Married Filing Jointly Your Idaho tax minus the amount of credit for income tax paid to other states.

December 29 2021 By Cascade Library Staff. Contribute up to 16000 32000 if married filing jointly in a single year without incurring a gift tax. Investment Tax Credit 2021 Qualifying Depreciable Property Idaho generally follows the definition of qualified property found in the Internal Revenue Code IRC sections 46 and 48 as in effect before 1986.

If Idaho and another state tax the same income you may be eligible to claim a credit for taxes paid to the other state. Idaho Education Tax Credit. One-half of the amount donated.

In Idaho for youth rehabilitation programs like Idaho Youth Ranch there is a 50 tax credit for donations up to 400 if you file a joint return.

Idaho Residents To See Tax Relief Money As Soon As Next Week East Idaho News

Sitting It Out Idaho S College Go On Rate Falls Once Again

Idaho Receiving 5 6 Billion Through Arpa Now The Hard Work Begins Idaho Reports

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes East Idaho News

Idaho State Senator Floats Plan That Would Eliminate School Supplemental Levies Idaho Capital Sun

Analysis A Fight Is Looming Over An Unexpected State Surplus Bank On It

First Time Home Buyer Savings Accounts Idaho Realtors

Idaho Residents Start Seeing Tax Relief Money

How Do K 12 Education Tax Credits And Deductions Work Edchoice

Idaho Education Tax Credit Idaho Botanical Garden

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep